A Differentiated Strategy Focused on Outparcels

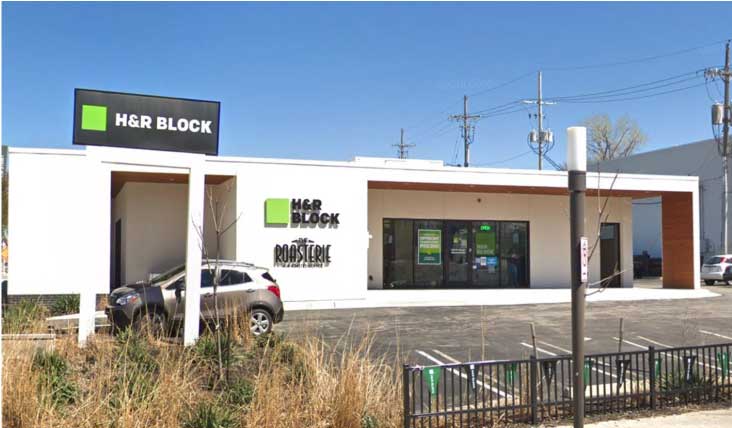

What is an Outparcel?

A freestanding building, situated with direct frontage on high-traffic roads with the best access & visibility, typically leased to a service oriented, internet-resilient, household name tenant under a long-term lease agreement

FrontView Outparcels Demonstrate Visibility and Frontage

FrontView Portfolio Snapshot

0

Total Properties

0M+

Square Feet

0

Brands

0

States

0% ~

Occupancy

0Yrs ~

Remaining Lease Term

0% ~

IG Tenants

0%

Top 10 Tenant Brands Concentration

High-Quality, Geographically Diversified Portfolio

FrontView has a 2.1 million square foot portfolio comprised of 278 properties in 31 states across 96 MSAs, with limited exposure to any single state or market

Industry Exposure (by % of ABR)

Top 20 Tenant Brands (by % of ABR)

The Difference

"Real Estate First" Investment Strategy

Highly differentiated investment strategy that includes a carefully considered set of criteria

Expertise

An average of more than 20 years of real estate and/or net lease real estate experience, developing, acquiring, and repositioning assets

Resilient

Portfolio Occupancy rate of ~99% as of June 30, 2024.

FrontView REIT’s “Real Estate First”

Investment Strategy

-

Prime Properties in Desirable High-Traffic Locations

-

E-Commerce Resistant Tenants

-

Favorable Layout, and Site Position within

-

Locations that Appeal to Diverse Tenant Types

-

Sites with Potential for Value Creation

-

Smaller Asset Size

Why Our Outparcels?

.

-

Target Well-Located Outparcel Properties While Maintaining a Highly-Diversified Portfolio

-

Broad Market Relationships Drive Acquisition Pipeline

-

Potential Growth through Long-Term Net Leases with Strong Contractual Rent Escalations

-

Proactively Manage Our Portfolio

-

Actively Manage Our Balance Sheet to Maximize Capital Efficiency

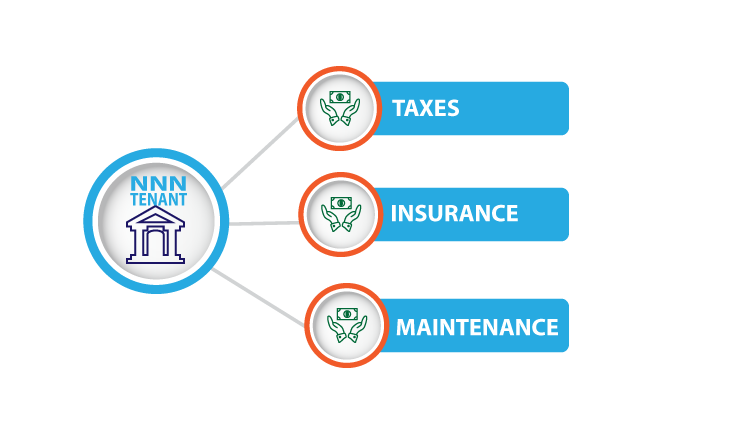

What Is A Net Lease?

.

-

A Net Lease Typically Require Tenants to Pay Real Estate Taxes, Property Insurance, and Operating Expenses Which Protect Landlords From Rising Costs

-

Limited CapEx Typically Required For Double net leases in the Space

-

Contractual Rental Escalations Through the Term are Typical

-

Our Net Leases Typically Have Landlord Friendly Assignment Rights

FrontView Leadership

Underwriting

- Deal selection

- Financial / credit underwriting

- Market analysis

- Site scoring model

- Investment Committee Reports

Finance & Accounting

- Property acquisition closings

- Financial reporting and analysis

- Investor and lender relations support

- KPMG (auditors) interface

Asset Management

- Property acquisition due diligence

- Tenant relations post-closing

- Property site visits

- Active management of properties

Legal, Insurance & Environmental

- Property acquisition legal support, lease, REA’s, title review, use restrictions

- Lender transactional support

Technology

- Billing and

payment systems - Data storage and backup

- IT support and

business continuity

Human Resources

- Hiring, onboarding

- Initial and ongoing training

- Annual reviews

- Employee benefits

Environmental, Social, & Governance

Corporate Responsibility:

We aim to operate our business in a way that has long-term, positive impacts for our stockholders, employees, tenants, other stakeholders, and the communities where we live, work, and own our properties

Environmental

- Partner with tenants to promote environmental responsibility and energy efficient facilities

- Implementation of energy conservation practices in the corporate office

- Continually work to find and roll out programs at properties that support these goals

- Encourage tenants to include LED lighting, electric charging stations and water conservation strategies at properties

Social

- Cultivate a workplace culture driven by diversity and inclusion

- Commitment to employee well-being & satisfaction in the workplace

- Community engagement encouraging volunteer opportunities throughout the year, among other activities

Corporate Governance

- Diverse management team and board of directors with independent committees

- Best practices in line with the Board’s code of ethics

- Corporate governance structure that closely aligns our interest with those of our stockholders

FrontView REIT Sample Acquisitions

FrontView REIT continues its acquisition strategy of assembling a carefully selected national portfolio of outparcel properties.